Introduction as the book profit based on ind as compliant financial statement is likely to be different from the book profit based on existing indian gaap the cbdt constituted a committee in june 2015 for suggesting.

Minimum alternate tax mat pdf.

Initially the concept of mat was introduced for companies and progressively it has been made applicable to all other taxpayers in the form of amt.

For fy 2019 20 tax payable is computed at 15 previously 18 5 on book profit plus applicable cess and surcharge.

Year it is a new tax controversy.

Over the last year foreign portfolio investors fpis have been asked to pay mat on the past capital gains.

This tax is computed using a separate charging section altogether.

In this part you can gain knowledge about various provisions relating to mat and amt.

In the case of a non corporate taxpayer to whom the provisions of alternate minimum tax amt applies tax payable cannot be less than 18 5 hec of adjusted total income computed as per section 115jc.

15th june 2017 1.

Mat is levied at the lower rate of 9 plus surcharge and cess as applicable for companies that are a unit of an international financial services centre and derive their income solely in.

For provisions relating to amt refer tutorial on mat amt in tutorial section.

Minimum alternate tax mat markets and mayhem.

Faced with requests for clarity the mat provisions were amended in 2015 to exempt fpis from paying mat on capital gains.

With mat companies have to pay up a minimum amount of tax to the government.

Minimum alternate tax mat.

It was introduced in the year 1987 and.

Understanding the concept of liability to pay minimum alternate tax mat and alternate minimum tax amt and various provisions like book profit dividends paid or proposed depreciation deferred tax income of foreign company etc.

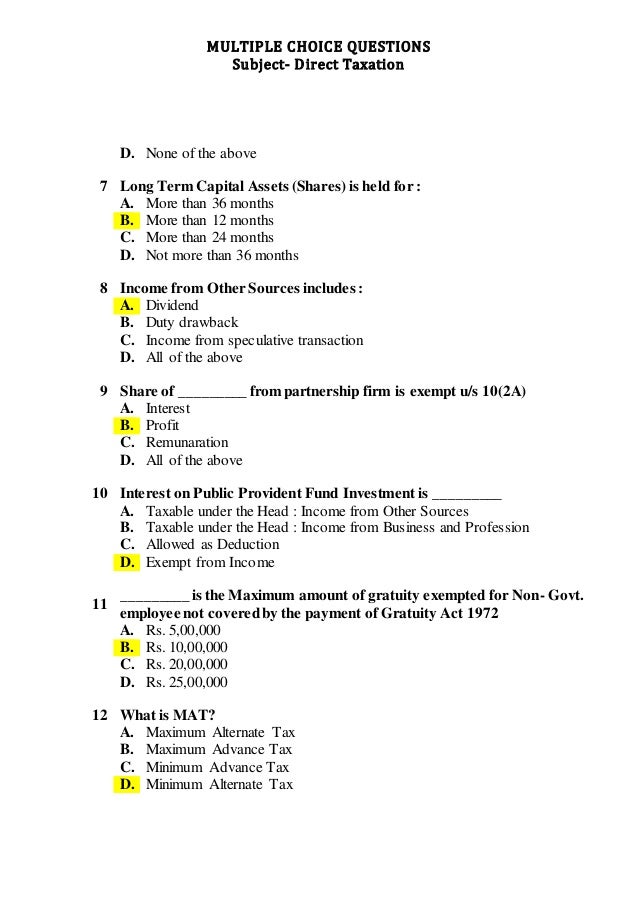

Mat and amt mat stands for minimum alternate tax and amt stands for alternate minimum tax.